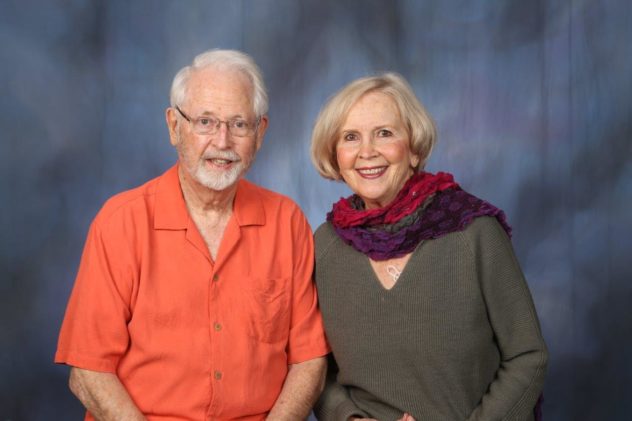

The Beverly and Bill Goldner Charitable Fund is able to provide immediate assistance after disasters like Hurricane Ian.

The Beverly and Bill Goldner Charitable Fund is able to provide immediate assistance after disasters like Hurricane Ian.

The Bill and MaryCarlin Porter CFFK Charitable Fund supports a myriad of community organizations that represent their unique interests.

Is 2024 the year that you will join the dozens of local individuals and families who have chosen the easy way to manage their philanthropy? A donor-advised fund is a giving vehicle that allows you to support all your favorite charities through one account. You get an immediate tax deduction by making a charitable contribution to the Community Foundation which goes into your named fund and is invested in a pool with millions of dollars. You can request grants to nonprofits anytime – they can be local nonprofits, in your hometown, your Alma Mater – any U.S. 501(c)(3) organization.

Your accountant will love you! Donor-advised funds streamline the giving process by consolidating all your charitable contributions into a single account. Rather than bringing your accountant a file of donation receipts, you will simply provide one document from the Community Foundation. For the most part, checks you request for nonprofits are sent or delivered to the charity within a day or two, much faster than the national firms.

Your Community Foundation team has knowledge about the specific needs, challenges, and opportunities in the Keys. You will gain access to their expertise, networks, and understanding of local nonprofits, maximizing the impact of your donations. They have in-depth and inside knowledge of current and future initiatives and projects, including those managed by small and emerging nonprofits that do good work but don’t have high visibility or funding.

Your Community Foundation team can work closely with you to understand your charitable interests, provide guidance on effective giving strategies, and offer tailored solutions to meet your specific goals. This approach ensures that your giving is aligned with your values and has a meaningful impact. Alternatively, you can request your checks to go to nonprofits by email or on your personal online portal 24 hours a day, 365 days a year, without having to talk to anyone!

You can contribute to your fund during high-income years for greater tax benefits and distribute donations to nonprofits over time as needs arise, avoiding capital gains tax by donating appreciated assets, such as stocks or real estate. You may maximize your tax benefits by “bunching” two years of charitable contributions, writing a check to the Foundation one year and itemize deductions for that year, then take the standard deduction the next year.

Giving through a donor-advised fund grants a level of anonymity if desired. You can support causes discreetly, preserving your privacy if you choose a fund name that is not your family name. Thank you letters and communications will go to the Community Foundation and be forwarded to you, so you will avoid solicitation calls, emails, and direct mail. The Foundation can still publicize your fund and grants through a giving web page or “big check” presentations.

The Community Foundation is in its 27th year and has a successful record of long-term growth of its funds. You gain from the expertise of the Foundation’s investment consultant, CAPTRUST, local investment committee, and access to institutional funds not available for individual investors. By strategically investing your fund’s assets, you can maximize the impact of your giving and support your favorite nonprofits with larger grants in the future.

The Community Foundation expects grant applications from more than 50 nonprofits in the Upper, Middle, and Lower Keys this fall. Only our donor-advised fund holders have the opportunity to select one or more proposed projects that they would like to fund (the entire dollar request or part of it). You get to see the requests before our grants committee makes their choices, so you can fund your favorite proposals.

As a donor-advised fund holder, you will be invited to private Community Foundation social and networking events where you can connect with other donors, nonprofit leaders, and stakeholders. You will also be invited to special presentations with our investment firm. By participating, you can deepen your understanding of local needs, build relationships with like-minded individuals, and contribute to the community’s collective well-being.

One key advantage of working with the Community Foundation of the Florida Keys is the ability to respond swiftly to emerging community needs. If you are open to it, the Foundation staff can let you know how you can help to quickly identify pressing issues and direct resources where they are most needed. This agility allows for timely and impactful grantmaking, addressing urgent challenges and supporting local organizations in real-time.

The Community Foundation is dedicated to the long-term well-being of the Florida Keys, and actively collaborates with community partners to address systemic issues and create sustainable change. As a fund holder, you become part of a collective effort to build a stronger and more resilient community. By transitioning your fund to become permanent and/or naming successors to your fund, you can leave a legacy and engage future generations in philanthropy.

The minimum amount to open a fund with the Community Foundation of the Florida Keys is $10,000. You can start your fund with a check, stock, or a check from your private foundation or current donor-advised fund. To receive a Donor Advised Fund Agreement, contact Jennifer McComb at jen@cffk.org or 305-809-4991. In the Middle or Upper Keys, contact Elizabeth Brown at elizabeth@cffk.org or 305-809-4992.