Helping clients put plans in place to benefit their children and the community for the future is important to Marathon estates attorney Kathleen Hendrickson. “It’s the one area of law that actually helps people,” she says.

Kathleen has been advising clients on estate planning, trusts, and wills in Florida for most of her nearly 40-year career. She encourages all her clients to have a plan that benefits others, especially if they have children or want to leave money to charities. “If you don’t have a plan, the state has one for you that may not be what you want,” she says. Protecting people and causes that matter is critical.

Similar to the national trend, Kathleen has recently seen an increase in people creating wills. The pandemic has been a factor, along with potential changes in federal tax laws. “Right now, people seem to feel like they need to do something, there’s less reluctance,” she says. “Some people may be more interested in charitable giving with future tax law changes, too. It’s been harder, but it may be better in the future.”

Kathleen is a graduate of Pepperdine University School of Law, with an LLM in Estate Planning from the University of Miami. Recently, she was one of ten business and civic leaders appointed as a charter member of the Community Foundation’s Middle Keys Advisory Council. The council is helping the Community Foundation expand its outreach, grantmaking, donor base, and public awareness in the Middle Keys.

Based in Marathon, Kathleen frequently travels up and down the Keys to meet with clients and to participate in activities. A widow with well-loved stepchildren, her personal passions are music of all kinds from tropical to country, as well as animals, especially dogs. Her Havanese dog, Duval Diva, is usually not far from her.

The Marathon attorney encourages her clients, especially those who have volunteered or been involved with nonprofits, to set up charitable giving as part of their plan and support their own passions. “People look closely at activities they are involved in,” she says, “They’re usually willing to give something to organizations they love.”

Contact the Community Foundation for assistance at cffk@cffk.org or call Jennifer McComb at 305-809-4991.

Kathleen Hendrickson, Attorney at Law, is a certified estates and trusts attorney in Marathon.

When working with clients, advisors often determine how they feel about giving to their community. Working out a charitable giving plan that meets the goals of both partners may be challenging, but the end result is not only rewarding for the donors, their giving may have a significant impact on meeting pressing community needs.

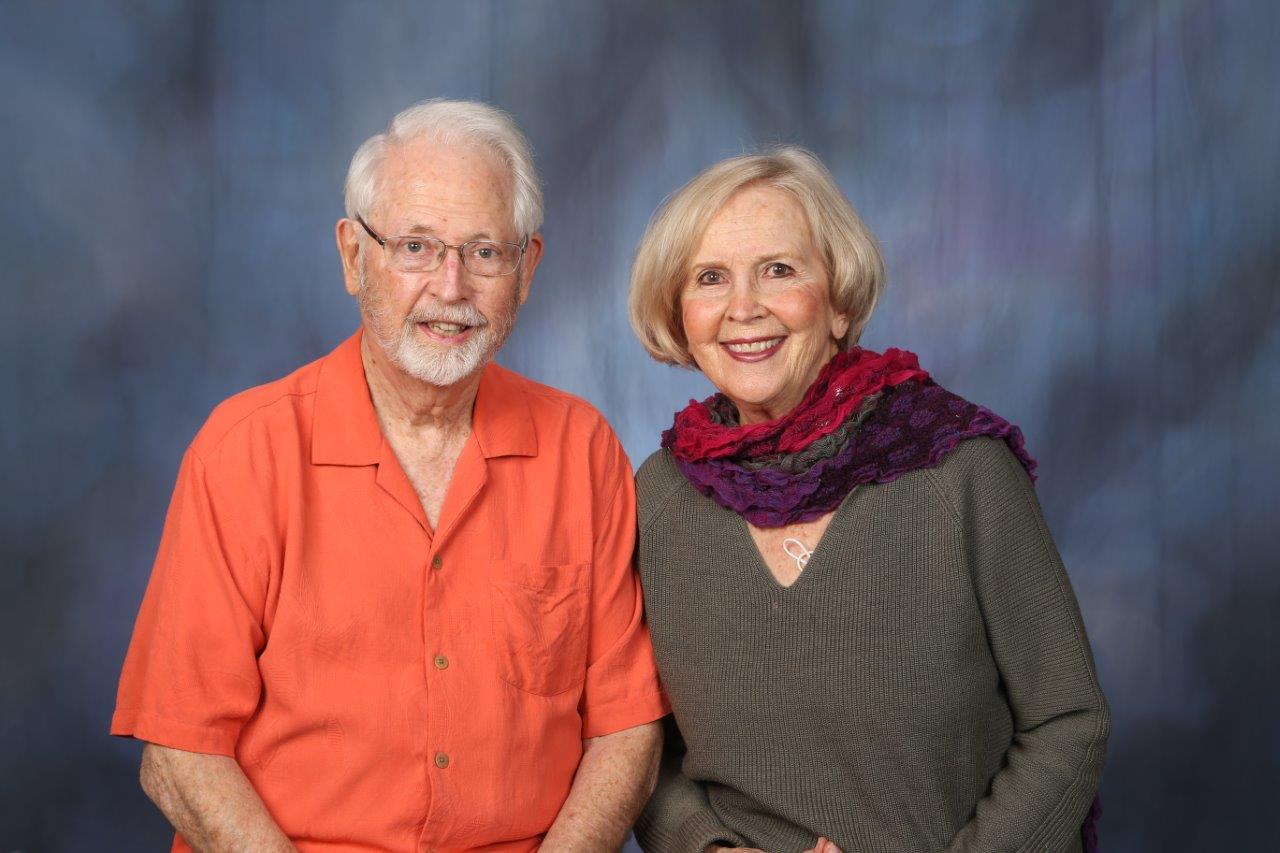

When Bill and MaryCarlin Porter first moved to the Keys more than 20 years ago, they turned to the Community Foundation to help with their charitable giving. They set up a donor-advised fund that gave them the opportunity to direct tax-deductible contributions to support the needs of local charities and bolster their personal passions in the community.

Today, the two civic leaders are making a lasting impact throughout the Keys. The nonprofits and the programs they’ve assisted are innumerable, including the Florida Keys Council of the Arts, the Key West Tropical Forest and Botanical Garden, the USCGC Ingham Maritime Museum, Fringe Theater Key West, The Studios of Key West, and countless more.

Working together, the Porters are thoughtful, strategic and have a solid giving plan. Says Bill, “We’ve reached out personally and found out what the organizations needs are and how we could help them fulfill their missions.”

They then evaluate how past grant awards have been spent, which nonprofits might need a bigger boost in a given year, and finally determine how much to give.” Says MaryCarlin, “We show up in person and look at the results. We get into the weeds.”

Having a solid charitable giving plan like the Porters creates rewarding giving experiences for both partners and helps them make an even bigger impact. The Community Foundation can help professional advisors work with couples to design specific giving strategies.

In the recent Giving As A Couple report, Rockefeller Philanthropy Advisors reinforces tenets to develop and activate a charitable giving strategy that matches the couple’s goals and values.

Among the report’s suggestions:

If advisors are representing couples that include women, it’s worth checking out Women Give 2021: How Households Make Giving Decisions, a study released last month by the Women’s Philanthropy Institute at Indiana University Lilly Family School of Philanthropy. The authors of the study observed notable trends in how partners–not just women–approach giving. According to the report:

Bill and MaryCarlin Porter make their charitable giving decisions jointly. And they not only give financially, but they also volunteer at numerous nonprofits they support. “Be a philanthropist and also work with the organizations,” says MaryCarlin. Volunteering can help donors understand the needs first-hand and lead them to make an even more significant impact in the community.

As always, your Community Foundation looks forward to supporting you as you help your clients achieve their family’s charitable giving goals.

Heads up about tax deductions and crowdfunding platforms: Many donors are making contributions to entities that don’t fall under a specific IRS code, but feel charitable nonetheless because the dollars are helping people in need. Perhaps you’ve participated in a GoFundMe fundraiser to help a specific person or family.

These vehicles, along with other crowdfunding platforms, typically do not meet the qualifications for a charitable organization under Section 501(c)(3), usually because the funds are earmarked for a particular person or persons.

According to a Lilly Family School of Philanthropy survey, nearly one-third of respondents said they donate at least once a year to a crowdfunding venture, especially responding to family members and close friends in need.

Even with the increase in popularity of crowdfunding and online fundraising platforms, the IRS has only just begun to issue guidance. Consider Private Letter Ruling 2016-0036. Here, the IRS referenced “detached generosity” and noted that giving to strangers on a platform such as GoFundMe did not generate the “quid pro quo” that is an automatic knock-out punch for charitable deduction eligibility. Still, the IRS indicated that the absence of a quid pro quo is not enough to cause a transaction to rise to the level of a charitable contribution. Taxpayers and professionals still must pay close attention to the circumstances and facts of each situation.

You can give to support a wide variety of causes in the Keys, including scholarships and programs helping those others in need through the Community Foundation. Typically, these contributions are tax deductible. Be sure your clients talk to their accountant or other professional advisor about allowing deductions regarding donations to our community.

Many advisors want to bring up charitable giving in client meetings, especially while updates to tax and estate plans are underway. Indeed, many advisors believe they have a responsibility to raise the issue. But how?

Addressing charitable giving priorities with clients does not need to be hard. The key is to be interested, relevant, and authentic. Here is a tip for each.

Show genuine interest.

Dale Carnegie’s maxim, “To be interesting, be interested,” is good advice for nearly every social or business encounter. Especially with charitable giving topics, showing interest is important because giving is very personal and emotional. When you are reviewing a client’s tax return, for example, ask about the charitable organizations the client supports. You’ll likely be amazed at the richness of the stories behind each gift.

Stay relevant.

Tax reform is on the minds of many clients. This gives you an opening to talk about potential changes to the tax rates and what might happen to capital gains treatment. Explore each client’s balance of charitable interests versus leaving inheritances to family members. Charitable clients will be glad to know you are up to date on lobbying efforts of nonprofit sector leaders. Indeed, many charitable clients serve on nonprofit boards whose members also would find this information useful.

Be authentic about COVID-19.

Nearly everyone has been affected by the pandemic in some way. Sharing your own experiences and impressions of 2020 and early 2021 will encourage clients to open up. Charitable giving is a natural topic of this conversation. According to a study by Candid, U.S. foundations, corporations, and individual donors stepped up by granting more than $10.7 billion as of early 2021 to address pandemic-related challenges. “There is no doubt that philanthropy has responded to COVID-19 on a scale not seen before,” note the study’s authors. Inspiring statistics like these bring home the importance of charitable giving as part of a family’s overall financial and estate plan. And of course, please reach out to the Community Foundation of the Florida Keys for updates on how our board, staff, and donors continue to meet the COVID-19 challenges in our own community.